This update is a bit longer and more technical than those I have shared so far. It explains in a bit more detail what we are hoping to do with Pamoja groups and why, and it’s written to those more interested in the nuts and bolts. (No offense taken if the rest of you don’t read it!)

But first, some pictures!

Henri had them work in groups a lot, so that they could see what they already know.

Edmund writing the group’s suggestions.

Henri Kanyumi, ladies and gentlemen. He really knows his stuff, as he has been doing Pamoja training for several years here in the Mwanza area.

Dethoni (in green) expressing his view. He is never shy.

Henri Kanyumi addressing the group. Aside from his experience with Pamoja, he is an excellent speaker who connected well with the leaders.

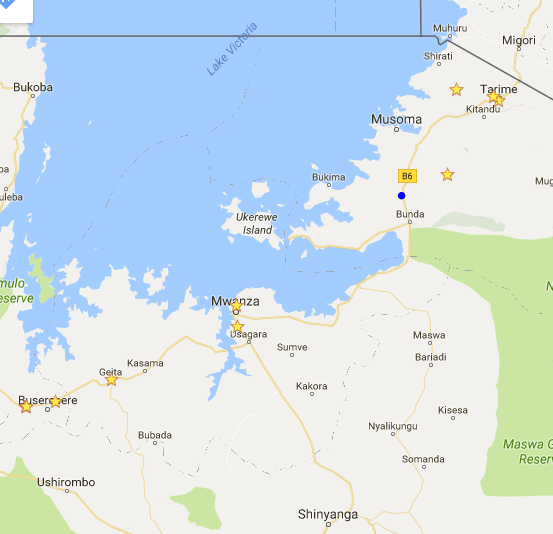

This last week, we took five days, paid an experienced facilitator, and trained the leaders of five churches in Mwanza and Geita on doing a church savings and loan group using the Pamoja method. During the next two weeks, they will find members for their groups, we’ll do a few more days of training, and then they will begin saving together.

The need we hope to address:

As Stuart Rutherford says, “The great irony of being poor is that you are too poor to save, but also too poor not to save” (Rutherford and Arora 11). Many of these folks need to have lump sums available at certain times for

- Emergencies. There are several different examples of this, but the most common is taking a sick child to the hospital and then buying medicine for them. In only 3 months here, there have already been two occasions where someone expressed their anxiety to me about needing to pay for this.

- Life-cycle events. Funerals and weddings, as in other places, are expensive in Tanzania, and a higher birth rate makes these more common than in the U.S. At the one funeral I attended, the family of the deceased was not only required to provide food for everyone who attended the funeral, but also for everyone who attended the mourning, which lasted several days.

- Opportunities. The most common and most important of these for our families is paying school fees. Indeed, it isn’t clear whether this should be cast as a opportunity or a necessity. As I spend more time with the Tanzanians and get to know them better, I hear this anxiety more and more often. Not far behind is the need to pay for seeds for planting. In this category are also opportunities to improve one’s situation and even rise out of poverty, such as opening a store or buying a taxi. (Rutherford and Arora 4-6)

Why is saving difficult?

The poor who we work with run into various hurdles with saving. The most prominent are relatives and neighbors who lay claim to any savings kept in the house, thieves, and the fact that traditional banks are not interested in deposits of $1 or less each day. (Rutherford and Arora 2)

How do Tanzanians attempt to meet this need?

Tanzanians use many methods, with varying success, advantages, and disadvantages. The three most common, though, are:

Livestock. Chickens, ducks, goats, and cows populate the streets and houses of Tanzania. I took the following pictures within 5 minutes of each other on my way home one day. The Tanzanians I talk to are surprised, and think it is pretty funny when I tell them this is not the case in the U.S. Tanzanians purchase livestock when they have a large lump sum of cash, and can sell them later when they need a lump sum. This way is troublesome though, as livestock can only be sold for fixed amounts, are expensive to feed, and may die suddenly. Indeed, Tanzanians purchase livestock as a small business and for prestige (see note at the end) as well, so saving may only be a background motive here.

Merry-go-rounds. (My Kenyan friend Zach told me these are called merry-go-rounds by English speakers in Kenya. I don’t know their Swahili name.) The way these work is that the members (15 or so) meet each day (or week, or month, depending on the group) and each puts in a certain amount, say 5000 shillings, roughly $2.50. Afterwards, one of the members takes the full amount, 75,000 shillings, roughly $37.5o. This continues each week until each of the members has had their turn to receive the sum. In the end, each member gets out only exactly what she or he put in, but it helps to satisfy the recurring need for lump sums.

Phone money. Almost anywhere I go in Tanzania, urban or rural, I see “M-Pesa” shops. These pictures were also taken within five minutes of each other on my way home. They are as common as stands selling fruits and vegetables; the nearest one is about a three minute walk from my house. Tanzanians who have an account with Vodacom, one of the largest cellular providers in the country, can (for a fee) save, withdraw, and send money at these small shops, starting with amounts as small as 300 shillings, roughly fifteen cents. They can check their balance via their phones, and even buy minutes via the money they have in their M-Pesa savings. M-Pesa also offers loans, although the process is a bit more complex. When I have asked Tanzanians how they save, “M-Pesa” is the most common response. In order to better understand this, I have opened an account myself, although with a different cellular provider, called Airtel Money.

Why Pamoja, when they have these other options?

Pamoja is a savings and loan group, of between five and twenty-five members who agree to put in some savings each week (the amount can vary, and these are called “hisa”). After this fund builds up, it can be used to meet the savings needs discussed above. In the Pamoja method, the members of a church are taught how do this, and they go find others in their community (often those who are not Christians) with whom to start a group. In this way, one church may start several groups, and this is what we are hoping for with our churches here in Mwanza. Why go to all this trouble though, when they have have merry-go-rounds and phone money?

First, the Pamoja savings and loan program has proven to improve living standards in quite a few churches in our area. I was thankful to meet and talk with one woman, Azteria, who was an example of this, and I have discussed our meeting some here.

There are technical reasons for this as well. It improves on the merry-go-round in that the members need not put in the same amount each week. If they have more to save one week, they can save more, and if one week has been rough, they need not drop out of the group simply because they cannot save as much that week. It also allows members to access the money they have saved whenever they need it, as opposed to the merry-go-round, where the members can only receive the lump sum at a certain preset time.

It improves on phone money in that there are no fees for saving and withdrawing. Indeed, a Pamoja group might even choose to charge a small interest rate on the loans it makes to its members, in which case the other members of the group will make money, rather than paying. (Rutherford and Arora 27-31) As a loan resource, it has the advantage that the members will likely charge a lower interest rate on the loan than M-Pesa, and the group is more familiar with its members, and whether a member is in a good position to receive a loan. An unfortunately common problem with many large-scale microloan providers is their tendency to make loans to clients who cannot repay, and to subsequently seize the few possessions the client has as payment for the debt.

What are we worried about?

We are encouraged about the advantages that Pamoja has over other saving methods, and by its track record. However, I thought I should mention some of our worries, for the sake of honesty, and in case you have some suggestions for how we might better prepare for these.

Pamoja savings and loan groups have more moving parts than other services, and moving parts create friction. Members might keep bad records, embezzle the saved money, or simply make groundless accusations that can cause the groups to disband. A second worry is that, as accessible as this service has been to the very poor, there are still some who are too poor to join. Someone who often goes for weeks at a time without any surplus cash will not be able to join, as Pamoja does require semi-regular savings. (Rutherford and Arora 31) Finally, as Azteria mentioned to me during our interview, groups tend to do best when they are formed of members of the same sort of profession, and will sometimes struggle when the members’ professions are quite different from each other.

Work Cited/Further Reading

Much of the way I have presented this is borrowed from the book The Poor and Their Money by Stuart Rutherford with Sukhwinder Arora, which you can preview here. It is based on years that the authors spent with people who do not have very much money in Southeast Asia, India, and Africa, and Eric Soard said this book, “Explains most of how poor people manage their money, which it took me three or four years to figure out”.

Note: Eric told me one story where they were asking each Tanzanian about one of the happiest days of his life. One of them thought about it for a minute, and then replied, “When I was young, I once had to sell all of my cows when I moved to a new place. One day a livestock trader came through and I had some extra money, so I was able to buy two cows. I was very happy, it was one of the happiest days of my life.”